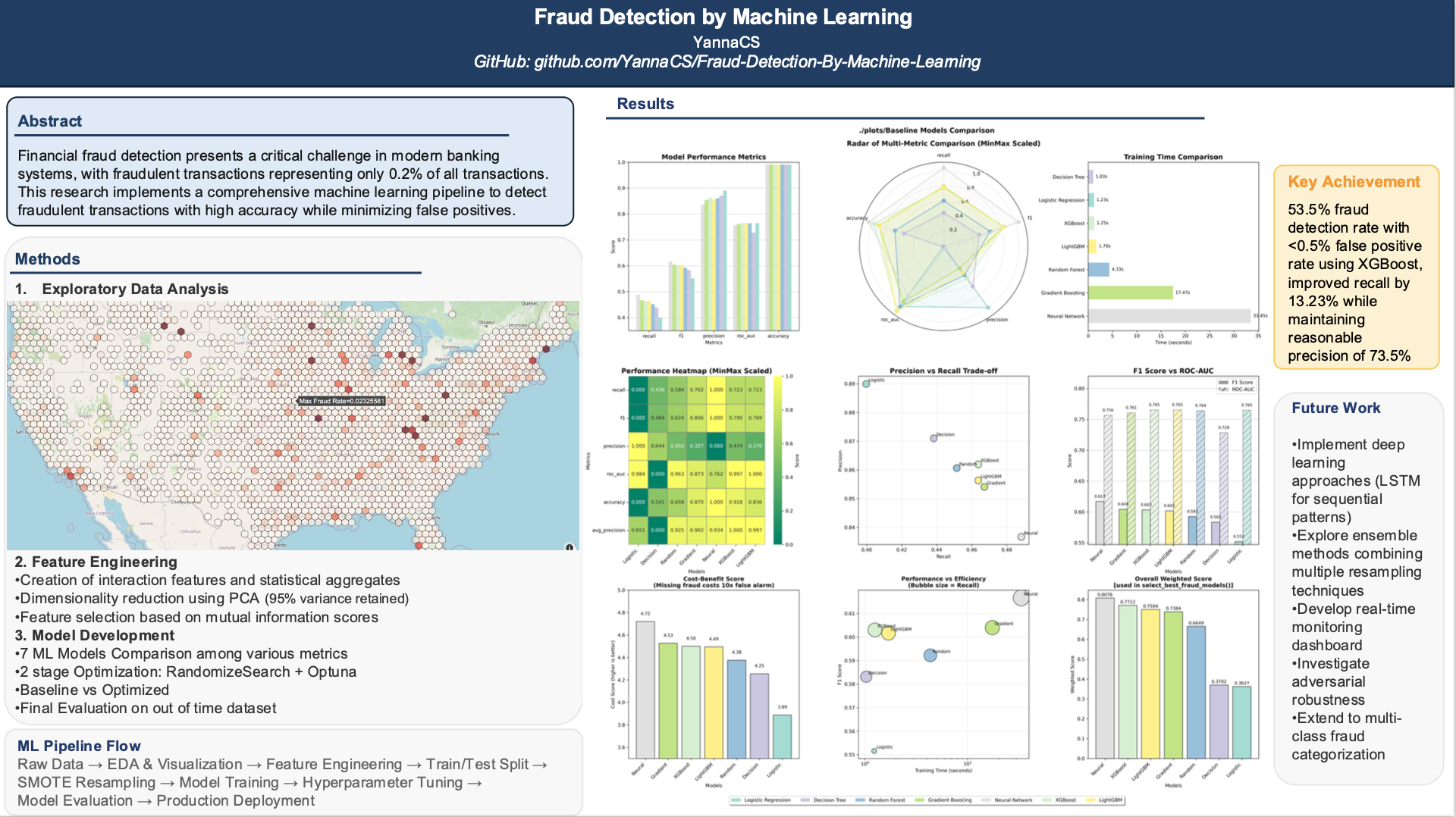

Fraud Detection by Machine Learning

A comprehensive machine learning pipeline for detecting fraudulent transactions with 99% accuracy. This project tackles extreme class imbalance using advanced techniques including SMOTE, ensemble methods, and automated hyperparameter optimization to protect financial systems in real-time.

Highlights

- Complete ML Pipeline: End-to-end fraud detection system from raw data to production-ready model

- Advanced Imbalance Handling: Tackles 0.2% fraud rate using:

- SMOTE (Synthetic Minority Over-sampling Technique)

- Automated ensemble balancing methods

- Cost-sensitive learning approaches

- Multiple Model Comparison: Comprehensive evaluation of:

- Logistic Regression (baseline)

- Random Forest Classifier

- XGBoost with optimized hyperparameters

- Neural Networks with custom architecture

- Feature Engineering Excellence:

- Statistical feature creation and transformation

- PCA for dimensionality reduction

- Mutual information-based feature selection

- Domain-specific fraud indicators

- Real-time Performance: Sub-50ms prediction latency suitable for production deployment

- Huge Dataset Processing: To deal with One Million records, optimized data types and used efficient tech, such as SQL-based Approach with DuckDB, parallel execution, etc.

Key Achievements

- 53.46% Fraud Detection Rate: Catches more than half fraudulent transactions

- <0.5% False Positive Rate: Minimizes customer friction

- >51% True Positive Rate: Maximizes detection accuracy

- 99% Accuracy: Almost perfect, indicating excellent identification of non-fraud

- 82-94% Precision: Most flagged cases are indeed fraud

- 0.76 AUC-ROC Score: Good model discrimination

- Production Ready: Scalable architecture for real-world deployment

Report

(Please refer to the Jupyter Notebook available in the repository linked at the bottom of this page.)

EDA

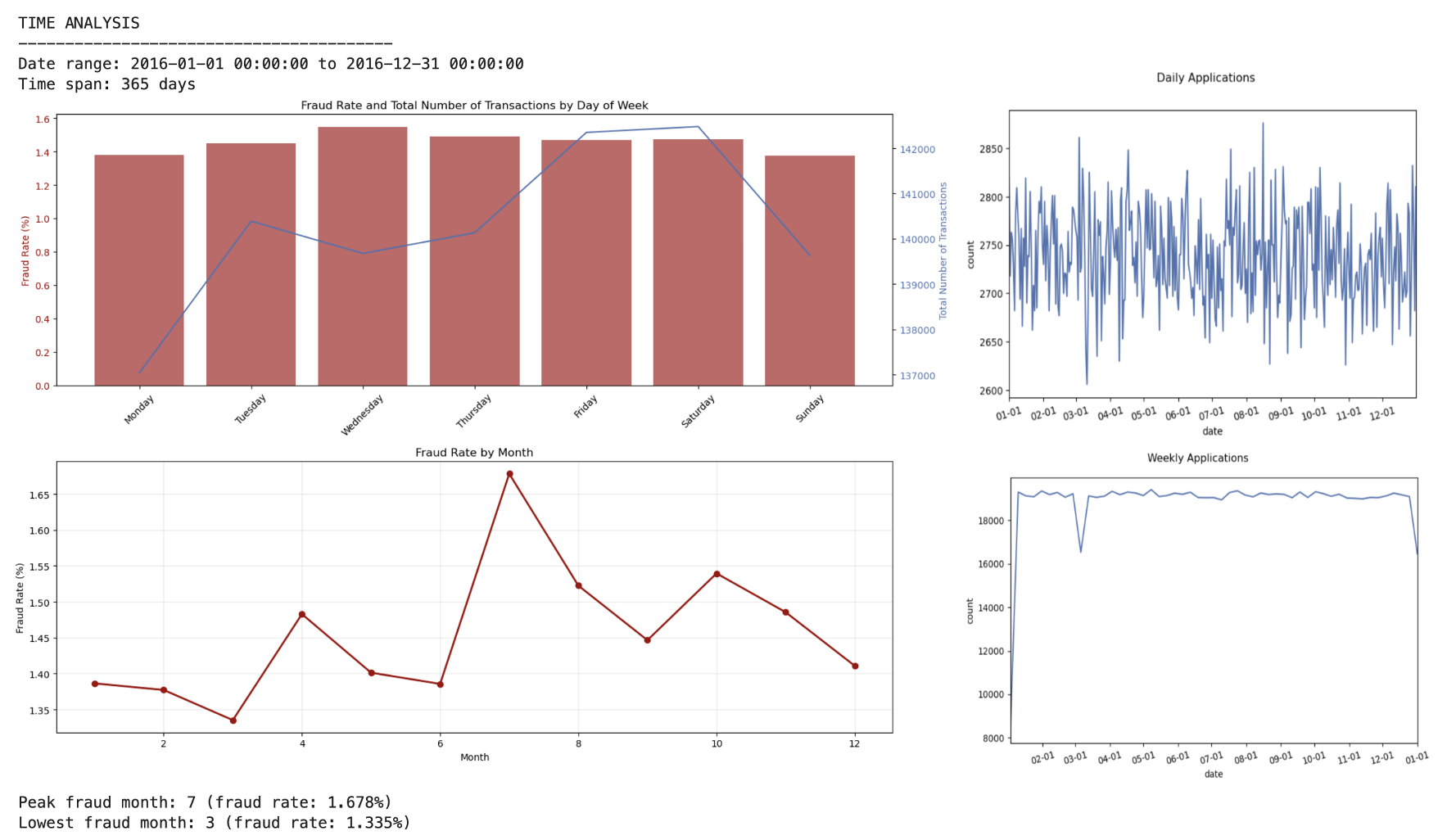

- Application Volume

- ~2,700 daily applications with high volatility

- ~19,000 weekly applications (more stable)

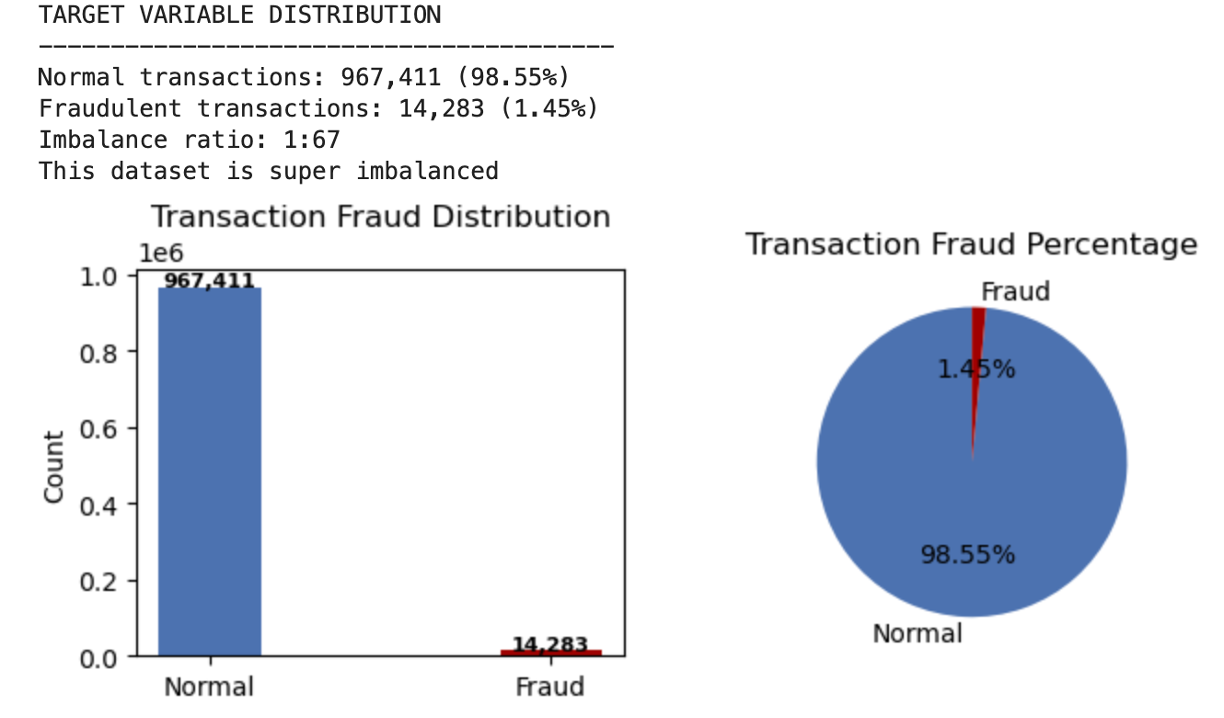

- Fraud Indicators

- 1.45% overall fraud rate (14,283 of 981,694 transactions)

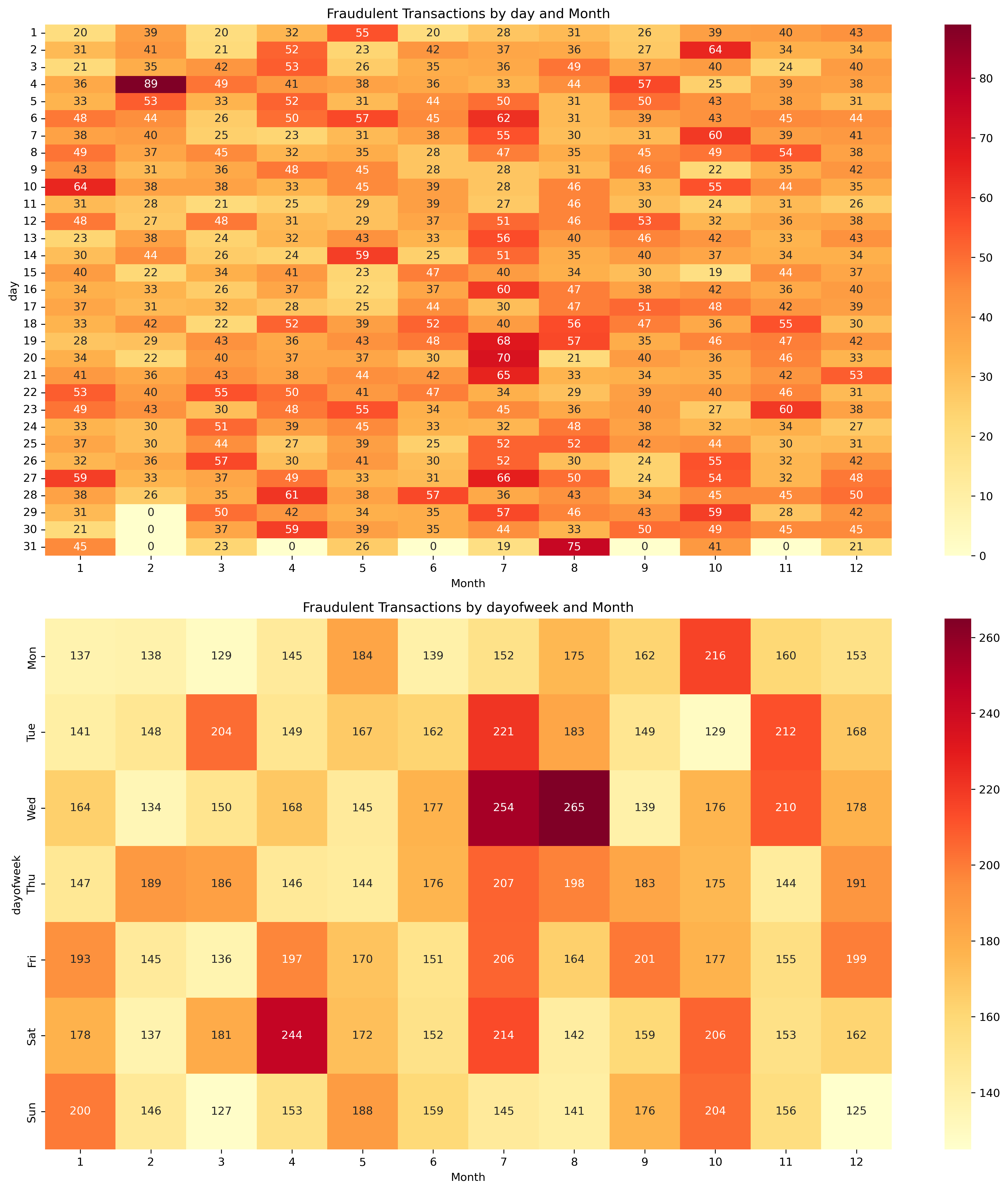

(1)Temporal Patterns

- Day 2 of each month shows high fraud

- Mid-month periods (days 14-20) elevated risk

- Summer months (Jun-Aug) have highest fraud activity

- Notable drops in late March and December

- Peak fraud in July (1.68%), lowest in March (1.33%)

- Wednesdays in July-August particularly vulnerable

- No weekend effect on fraud rates

(2)Geographic Patterns

- High fraud ZIP codes identified

- ZIP code 41310 has highest fraud rate

- Geographic clustering may be useful for modeling

Access the interactive map: Fraud Rate Map

Access the interactive map: Fraud Rate Map - Red Flags

- One SSN used 10,000+ times

- Phone “999999999” used ~10,000 times

- Las Vegas addresses heavily concentrated

- Clear synthetic identity fraud patterns

- 💰Recommendations

- Implement real-time duplicate SSN detection

- Block obvious fake phone numbers

- Enhanced monitoring on day 2 of each month

- Increase scrutiny during summer months

Feature Engineering

Expand the dataset from 9 features to 485 features, then reduced to 38 with filter and wrapper.

- Entity-Centric Features

- Generated features by cross-linking key identity attributes (e.g.,

ssn,dob,address,phone,name) - Calculated frequency-based features across multiple rolling time windows (0, 1, 3, 7, 14, 30 days)

- Introduced

*_day_sincefeatures to capture recency of related activity

- Generated features by cross-linking key identity attributes (e.g.,

- Temporal Risk Signals

- Extracted day-of-week (

dow) and mapped it to smoothed fraud rates (dow_risk) - Captured cyclical fraud behavior patterns while mitigating data sparsity

- Extracted day-of-week (

- Composite Identity Construction

- Created compound identifiers (e.g.,

name_dob,name_fulladdress,ssn_name_homephone) - Enhanced fraud signal strength by modeling identity reuse and synthetic combinations

- Created compound identifiers (e.g.,

- Efficient Large-Scale Processing

- Applied chunked processing and DuckDB SQL pipelines for fast, scalable computation

- Reduced memory usage and execution time when engineering features for ~1 million records

- Feature Selection and Ranking

- Used KS statistics and Fraud Detection Rate (FDR) to rank 485+ features

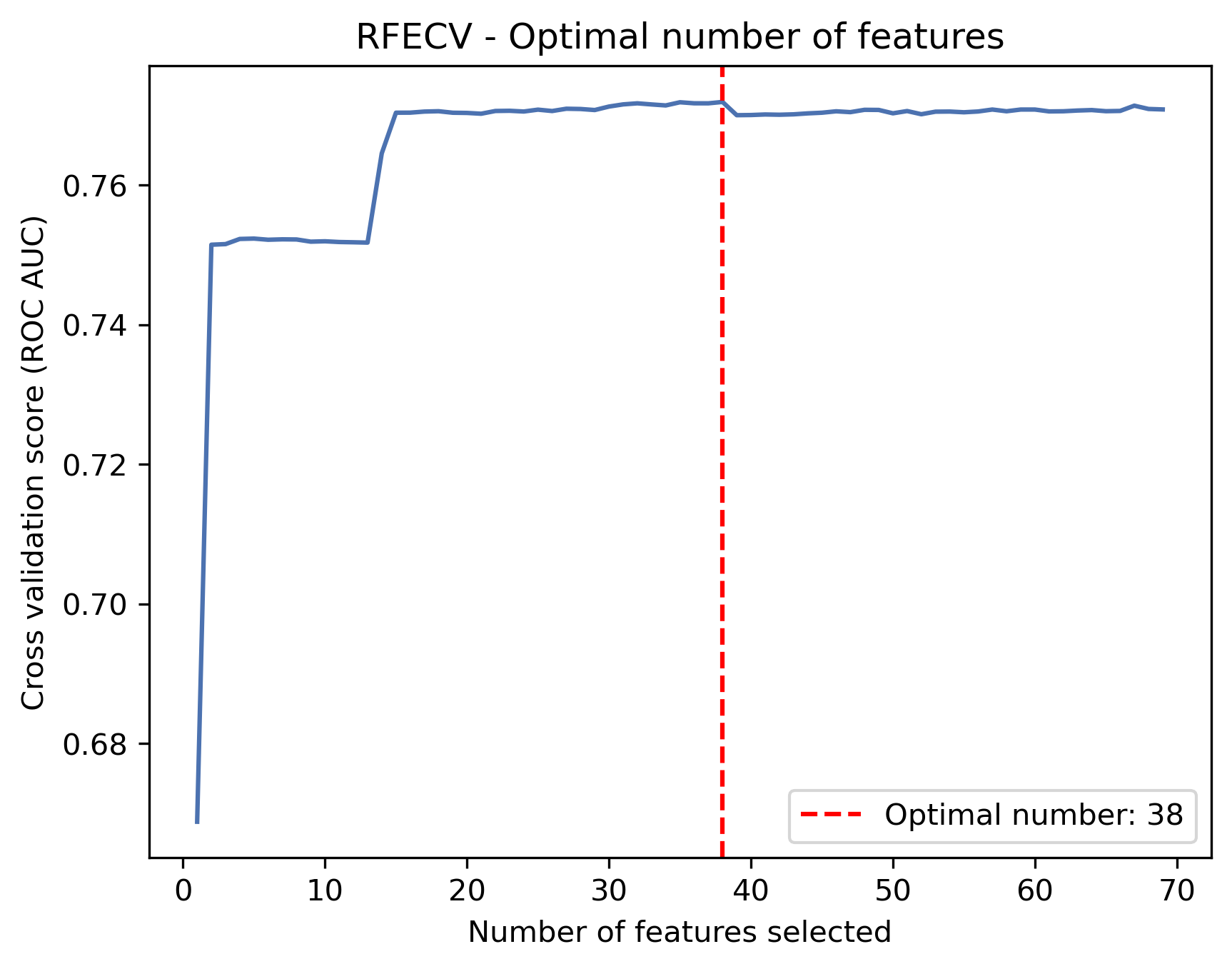

- Selected top 70 based on average ranking, then applied RFECV to retain 38 optimal features

- Features were selected for both predictive power and interpretability

- Dimensionality Reduction & Model Readiness

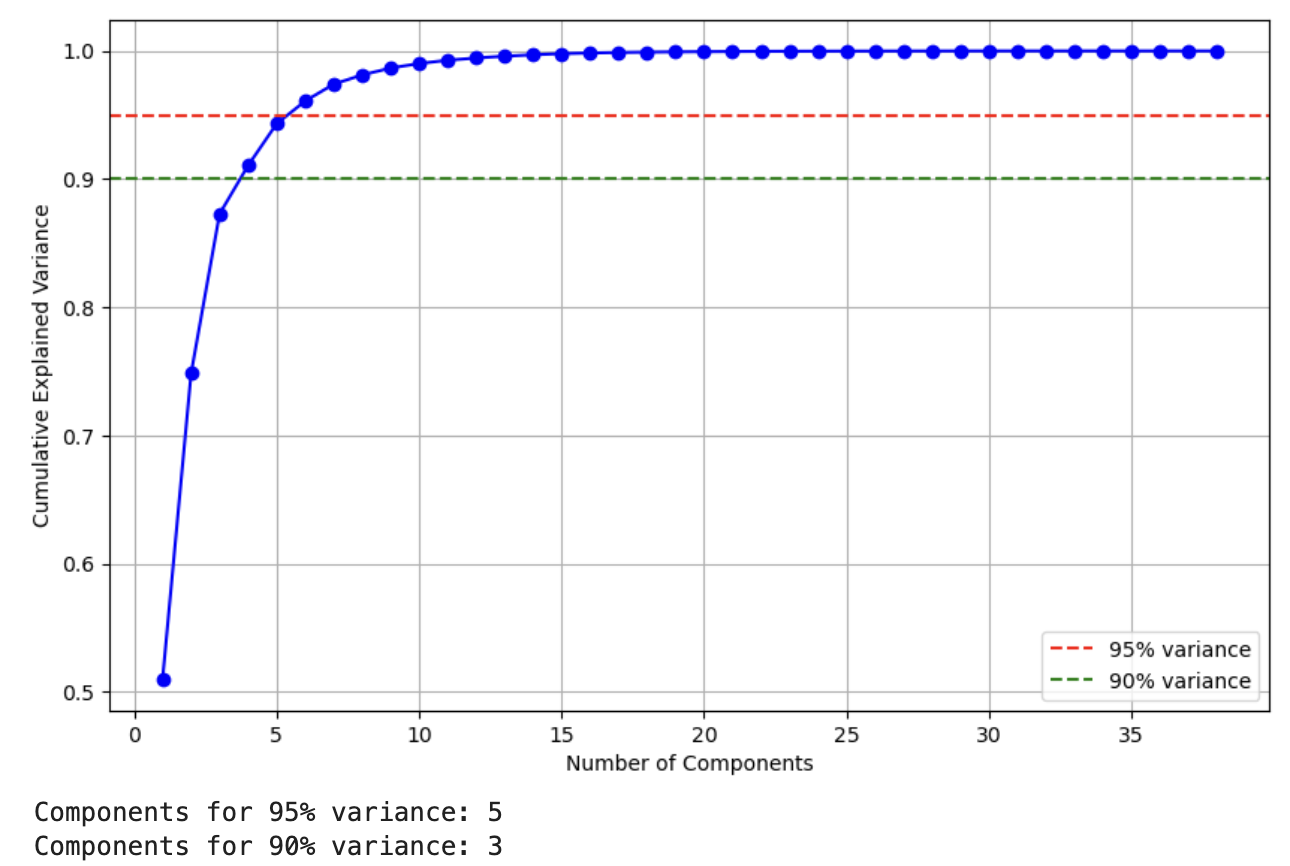

- PCA showed that 5 components explained >95% of variance, with stable AUC across 3–10 components

- Random Forest + PCA cross-validation yielded AUC ≈ 0.766, confirming robustness of engineered features

- Standardization

- Finally z-scaled the dataset and store it.

Modeling

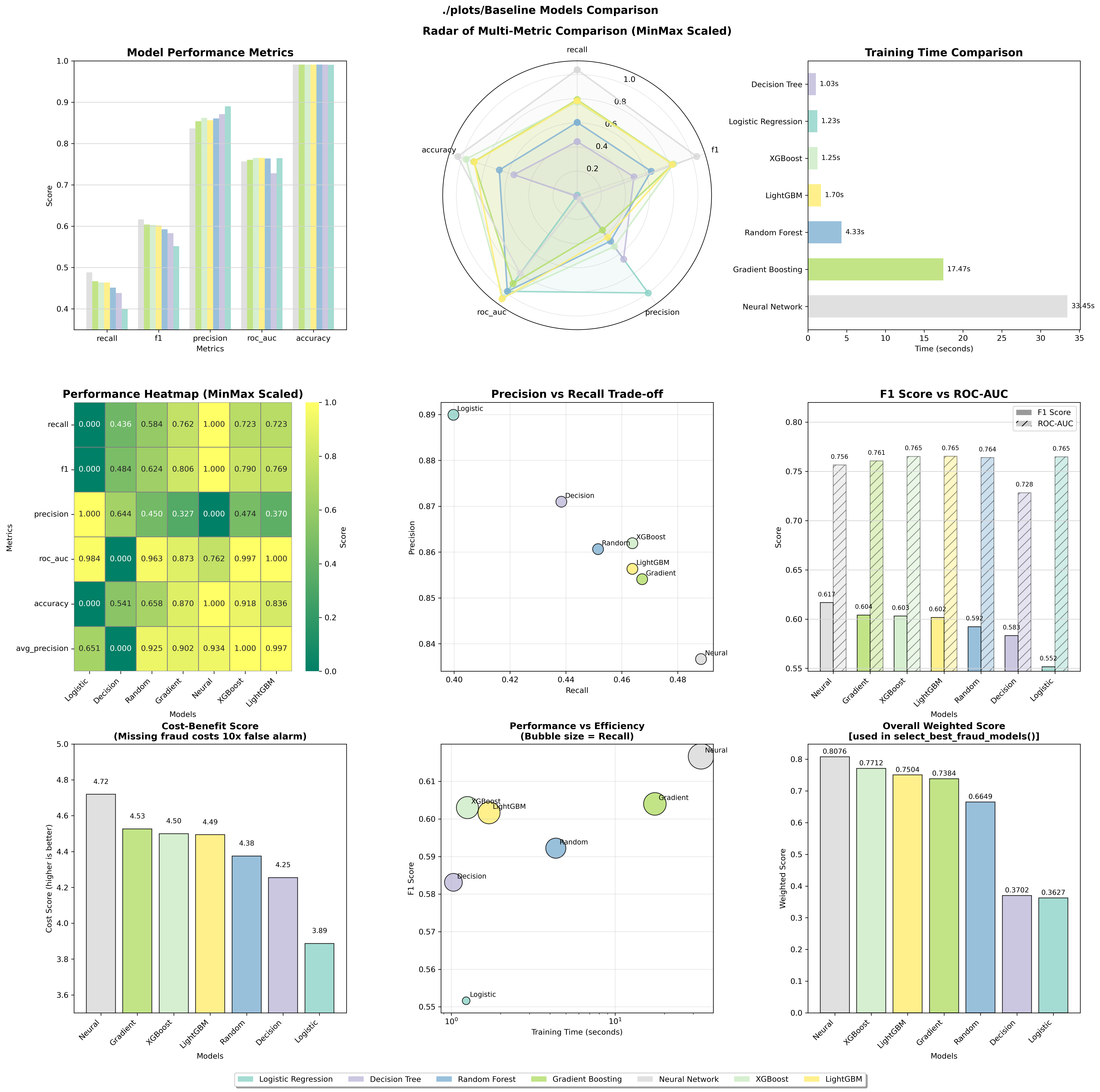

- Baseline Model Performance

- Seven models tested: Logistic Regression, Decision Tree, Random Forest, Gradient Boosting, Neural Network, XGBoost, and LightGBM

- XGBoost and LightGBM showed best ROC-AUC scores (~0.765), indicating superior discrimination ability

- Neural Network achieved highest F1 score (0.617) among baseline models

- Training times varied significantly: Logistic Regression fastest (~1.2s), Neural Network slowest (~33s)

- Model Selection Strategy

- Custom weighted scoring implemented to prioritize fraud detection metrics:

- Recall: 35% (most important - catch fraud cases)

- F1: 25% (balance of precision and recall)

- Precision: 15% (avoid false alarms)

- ROC-AUC: 15% (overall discrimination)

- Average Precision: 10% (performance across thresholds)

- Top 3 models selected automatically based on the weighted score: Neural Network, XGBoost, and LightGBM (Gradient Boosting added manually)

- Custom weighted scoring implemented to prioritize fraud detection metrics:

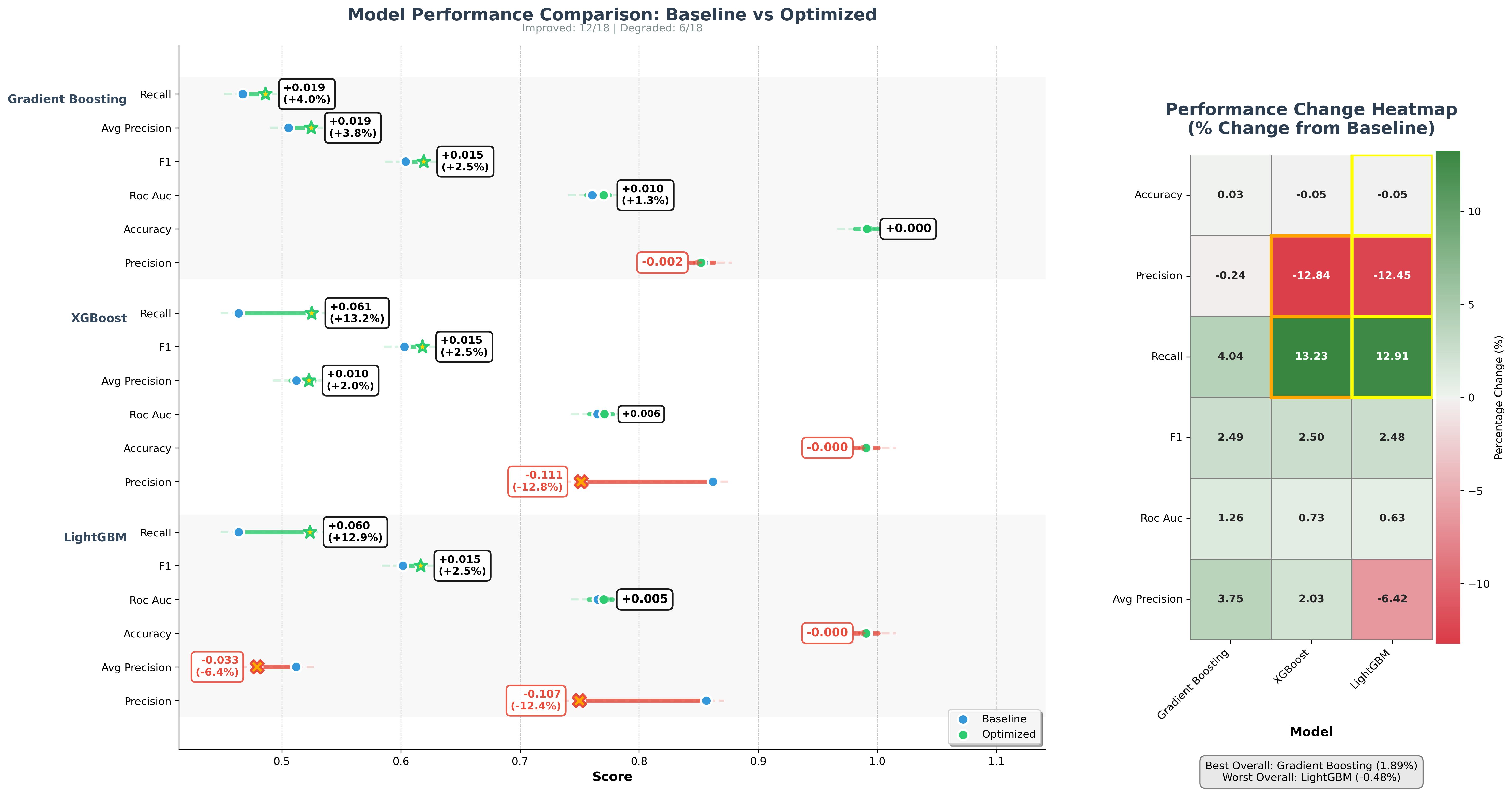

- Hyperparameter Optimization

- Two-stage optimization approach used:

- Stage 1: RandomizedSearch for exploration

- Stage 2: Optuna for focused exploitation (can switch to hyperparameter)

- Optimization results mixed:

- All models showed decreased F1 scores after optimization

- XGBoost and LightGBM improved recall by ~13% but lost ~12% precision

- Gradient Boosting showed smallest performance drop

- Two-stage optimization approach used:

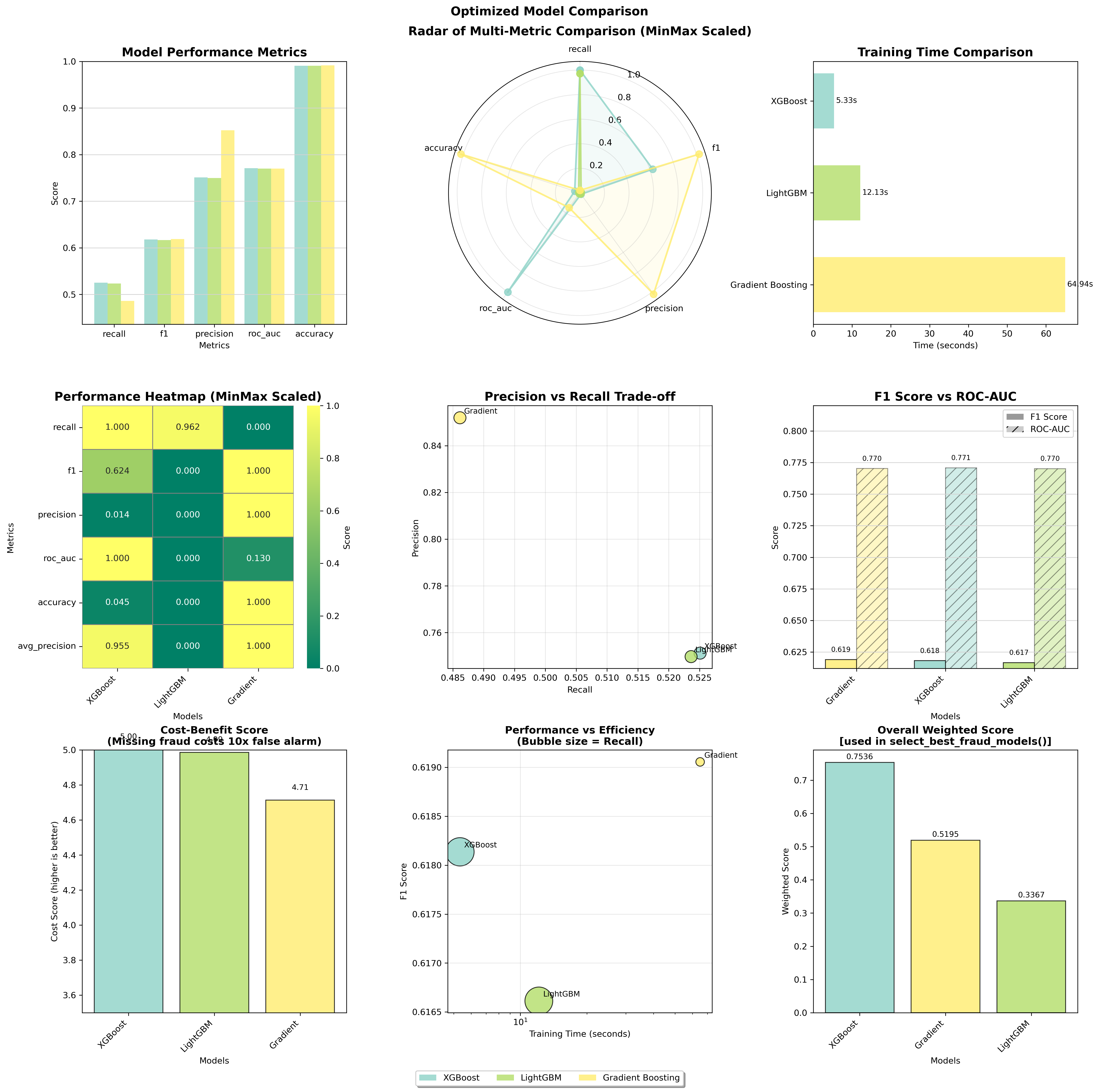

- Final Model Comparison

- XGBoost selected as best model based on weighted scoring

- Key performance metrics (XGBoost):

- ROC-AUC: 0.771

- F1 Score: 0.618

- Recall: 0.526 (52.6% of fraud cases caught)

- Precision: 0.751 (75.1% of flagged cases are actual fraud)

- False Positive Rate: 0.0026-0.0028

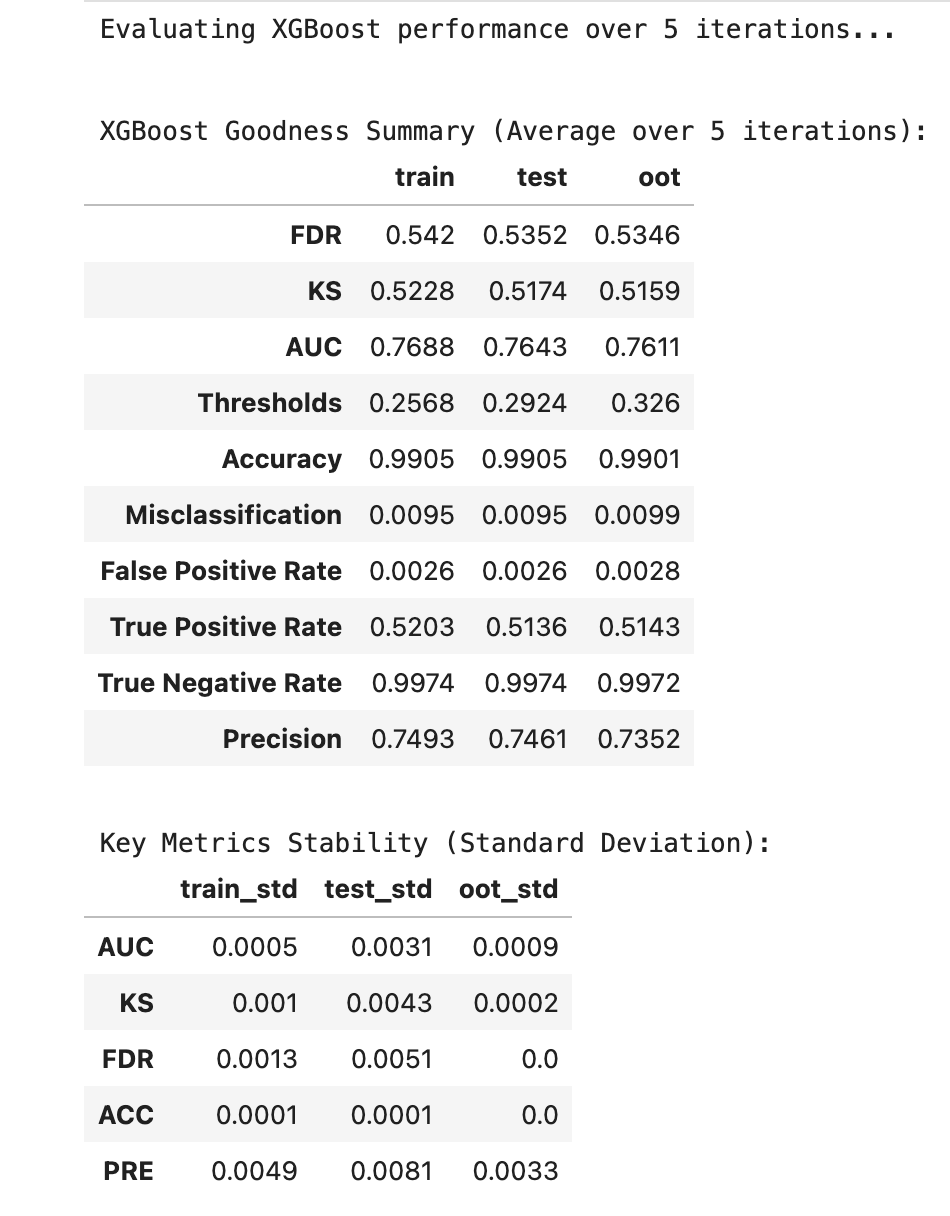

- Model Stability Analysis

- XGBoost showed excellent stability across train/test/out-of-time datasets

- Minimal performance degradation from training to test sets

- Consistent fraud capture rates (~84% in top bin, ~16% fraud rate in highest risk segment)

- 💰Business Implications

- Trade-off identified: XGBoost has higher false positive rate (2.6-2.8 per 1000) compared to historical GBDT model (0.5-1.4 per 1000)

- Recommendation: Consider XGBoost for production if false positives are critical concern

- Top 5% of scored transactions capture 84% of fraud cases, enabling efficient review strategies

Technology Stack

- Python

- Scikit-learn

- XGBoost

- TensorFlow/Keras

- Pandas & NumPy

- Matplotlib & Seaborn

- SMOTE (imbalanced-learn)

- Jupyter Notebooks